Do You Really Need a Cash Wedge in Retirement?

An Unexpected Retirement Question

Robert (Rob) is a 64-year-old DIY investor living in the B.C. Okanagan. Born in 1961, he is turning 65 in February 2026 and will be retiring at the end of that month after a long professional career.

Rob is comfortable managing his own investments; he’s used low-cost ETFs for the last 15 years, and before that, he used index mutual funds. During this accumulation phase of his life, he has never held any meaningful cash inside his portfolio; “cash is for emergencies and chequing accounts, not investments.”

Rob’s Research Before Retirement

As Rob began reading about decumulation strategies, he came across terms like cash wedges, guardrails, and total return approaches. He noticed that commentary from Canadian sources strongly favoured a cash wedge, usually in the context of a warning about sequence-of-returns risk.

The Surprise

The surprising thing that Rob discovered was that most of the U.S. publications he read, including those from writers with financial planning credentials, didn’t refer to cash wedges at all. Some even argue that such an approach was inefficient or unnecessary.

This left Rob quite confused. “Do I need a cash wedge or not? Why do Canadians talk about this so much and Americans so little?”

Why Does Canada Love Cash Wedges While the U.S. Mostly Doesn’t?

Why do Canadians Hear So Much about Cash Wedges?

Canadian financial culture

There may be a stronger behavioural finance influence in Canada. Risk aversion and peace of mind are important for many retirees, perhaps more than is the case for American retirees (although I hesitate to create caricatures of cautious Canadians vs. aggressive Americans).

Many professionals in the financial field emphasize this approach. For example, Daryl Diamond, a Winnipeg-based financial planner, has asserted a copyright on a strategy entitled The Cash Wedge©, and I have certainly seen it discussed in many other publications.

Perhaps evidence in favour of a cash wedge, especially among DIY investors, is the rise in availability and use of HISA ETFs

Christine Benz is an important outlier in the U.S.

I will note that Morningstar’s Christine Benz is a key U.S. voice supporting a cash bucket or two-year buffer concept. Her “bucket approach” is U.S.-friendly packaging of a cash wedge.

Why cash Wedges are Less Common in the U.S.

Total Return Tradition

While the influence of William Bengen of “4% rule” fame (Note: Bengen never used the word “rule” in his 1994 Journal of Financial Planning article, “Determining Withdrawal Rates Using Historical Data”) is certainly well-known now in Canada, it was more influential in the U.S. earlier on. Vanguard and the Bogleheads community, long-time influencers of investment approaches in the U.S., were also not as well known in Canada, but they eventually had a significant impact on low-cost investing in broad-based, carefully considered portfolios held for the long term. Long-term investing generally does not give much consideration to a cash wedge or bucket.

Financial planning is much more advanced as an area of academic study in the U.S. compared to Canada, with several universities offering PhD programs in the field. This academic research may inspire more U.S. planners to emphasize investment policies like:

- Maintaining a long-term asset mix,

- Withdrawing proportionally, and

- Rebalancing methodically.

These kinds of systematic approaches are viewed as optimizing returns compared to maintaining a cash wedge. For example, Michael Kitces maintains that the evidence shows that rebalancing while following a total return approach is simple and effective when compared to bucket (wedge) approaches.

The Complication for Canadians: We Love our Asset-Allocation ETFs

VBAL, XBAL, ZBAL, and other Asset-Allocation ETFs dominate Canadian DIY portfolios

Well, dominate may be too strong a word, but asset allocation (AA) ETFs are very popular. They are simple, low-cost ways to get a fully diversified portfolio with a single purchase, and with automatic rebalancing, we have pretty well everything we need.

A problem may emerge at retirement, however, when you want to draw down your assets. With an AA ETF, there is no room for a cash wedge. You cannot selectively sell equities or fixed income, choosing whichever one is performing better, to top up your cash allocation. Instead, sales are always in proportion to the internal mix of the ETF.

If we return to Rob, he has a bit of a dilemma. He admires the simplicity of AA-type ETF solutions. In fact, that’s been his approach since they debuted nearly eight years ago. However, he can’t do that if he wants to implement either a cash wedge or even use a total return approach that alternates between drawing from equities or fixed income, depending on which class has performed better.

The Insight: Different Philosophies; Both Have Their Points

Insight #1: Both countries’ approaches solve the same problem differently

To be clear, it is overstating it to suggest that these are somehow “national” approaches. Rather, cash wedges tend to be favoured among financial planning professionals in Canada, while American planners tend to favour total return approaches.

Cash Wedges (Canada)

- Manage behavioural risk.

- Reduce forced selling of equities in downturns.

- Creates psychological comfort.

For example, consider a retiree with a $100,000 portfolio and an annual withdrawal need of $12,000. She decides to keep two years of spending in cash-like holdings, which is $24,000. She invests this amount in a high-interest savings account ETF, such as PSA or CASH, or in a money market ETF like ZMMK. The remaining $76,000 stays invested according to her target long-term mix. Suppose she targets 60 percent equities and 40 percent bonds for the risk portion of the portfolio. She might hold $45,600 in a global equity ETF such as VEQT, combined with $30,400 in a fixed-income ETF like VAB or ZAG.

At the end of each year, she reviews the portfolio. If markets have been strong, she tops up the cash wedge back to $24,000 by selling from whichever asset class has grown the most. If markets have fallen, she draws the next year’s spending from the cash wedge instead and leaves the risk assets (the equity and bond ETFs) untouched until markets recover. Once the recovery occurs, she replenishes the cash wedge. The goal is to reduce the chance of selling equities or bonds after a market decline and to create a smoother experience for meeting spending needs.

Total Return (U.S.)

- Rely on asset allocation and disciplined rebalancing.

- Withdraw from the overweight asset class.

- Therefore, do not need a large cash bucket.

For example, let us suppose an American investor has a World Stock ETF like Vanguard’s VT, the Vanguard Total World Stock Index Fund, which tracks a market-capitalization weighted global equity index. She also holds BND, the Vanguard Total Bond Market ETF, which covers the broad U.S. bond market. If her target allocation is 60 percent equity and 40 percent fixed income, then in a $100,000 portfolio, she would have $60,000 in VT and $40,000 in BND. If it was a better year for bonds, such that VT was flat and ended the year at $60,000 while BND rose to $50,000, she would now be overweight in fixed income.

To bring the portfolio back to its target, she would withdraw the first $10,000 from BND. This would restore the 60 percent equity and 40 percent fixed income balance. If she needed $20,000, she might withdraw $14,000 from BND and $6,000 from VT. The new balance would be $54,000 in VT and $36,000 in BND. The total value would drop to $90,000, but the 60/40 target would be preserved because $54,000 is 60 percent of $90,000, and $36,000 is 40 percent of $90,000.

B. Insight #2: Canadian investors can recreate this U.S. approach, if they want to

It is not particularly difficult to accomplish the same total return approach in Canada, using Canadian-listed ETFs. If we follow the example above, you might combine VEQT, the Vanguard All-Equity ETF, with VAB, the Vanguard Canadian Aggregate Bond Index ETF.

Alternatively, Asset-Allocation ETFs are essentially made for a total return approach since the ETF issuer will rebalance automatically to return the ETF to its target mix. In this case, VBAL, by itself, would do the trick.

Doing it this way, without a cash wedge, may be behaviourally harder, since most people will not want to sell stocks when they are down, but technically it’s cleaner.

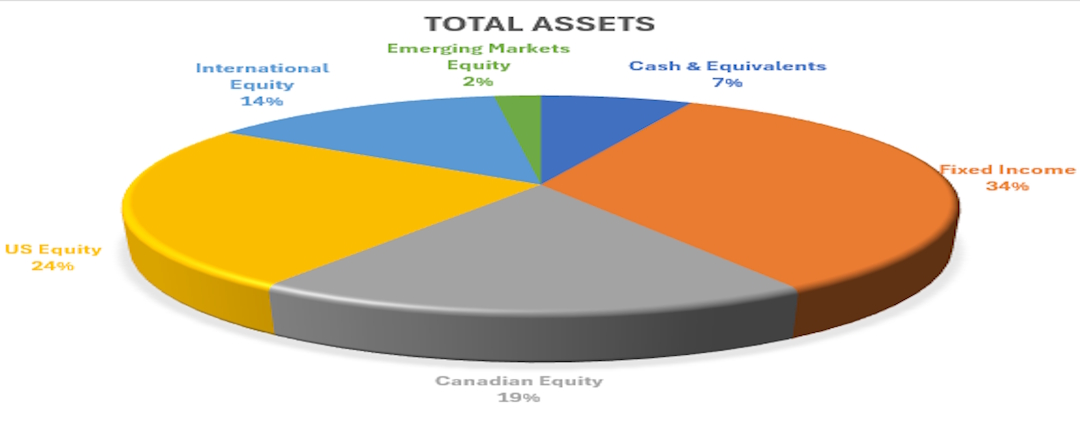

If we return to Rob, now that he’s approaching the decumulation stage, he has two choices. He can maintain a position in something like VBAL, a 60/40 ETF portfolio, and add a cash wedge like PSA, CASH, or ZMMK, the supposed Canadian approach, or he can just keep going with something like VBAL and not worry about a cash wedge.

Takeaway: Choose a Strategy That Fits You

To summarize the discussion, here are a few observations that you might find useful.

Canadian investors aren’t doing it “wrong”; U.S. investors aren’t doing it “right.”

- To repeat, there is nothing about the border that makes either approach exclusive to one country or the other. This simply describes a tendency.

The cash wedge is useful, but not mandatory.

- It is good if you value psychological comfort and simplicity.

- However, it is not a “required” addition to a retirement portfolio.

Asset Allocation ETFs are excellent tools, but are best for accumulation.

- They simplify investing, but they may reduce withdrawal flexibility depending on the strategy you want to follow.

Robert discovered the real takeaway:

- Retirement income planning is about aligning strategy with personality.

- Both approaches can work even if one might be deemed “sub-optimal.”

- The key is understanding why you might choose one over the other.

- Do you want that assurance of having cash available if the market drops when you need the money?

- Or are you content with an approach that might mean selling securities when they are down but holds the promise of greater returns over the long term?

What approach matches your goals, temperament, and retirement timeline?

This is the 305th blog post for Russ Writes, first published on 2025-12-01.

If you would like to discuss this or other posts, connect on Facebook, Twitter aka X, LinkedIn, Instagram, Mastodon, or Bluesky.

Click here to contact me for an appointment.

Click here and select FinPlan30: Financial Planning in 30 min under Specific Questions for a 30-minute free, no-obligation financial planning conversation.

Disclaimer: This blog post is intended for general information and discussion purposes only. It should not be relied upon for investment, insurance, tax, or legal decisions.