Twins, Tension, and Tolerance: Navigating the Risk Spectrum in Personal Finance

During my time in the discount brokerage world, I encountered individuals whose investment accounts seemed to function more like slot machines or roulette wheels. They would deposit money and bet it all on a single stock, implement aggressive options strategies, or day trade in and out of the same security all day long. In most cases, their strategies failed repeatedly, requiring them to top up their accounts with fresh funds. Their approach amounted to little more than a recipe for wealth destruction.

At the other extreme were investors who built meticulous “ladders” of Guaranteed Investment Certificates (GICs). For example, they might take $25,000, divide it into five $5,000 portions, and invest each in GICs with terms of one through five years. As each GIC matured annually, they would reinvest the proceeds into a new five-year GIC. These investors avoided mutual funds, Exchange-Traded Funds (ETFs), or individual stocks entirely. They weren’t willing to take any risk at all. While they rarely lost money outright, over the long term their portfolios struggled to keep pace with inflation.

In neither case was there sufficient balance in the investing approach. In today’s blog post, I’ll explore these two extremes through the story of fictional twins.

Meet the Twins: Jessica and Michael, Age 42

Jessica and Michael, born on the same day in 1983, are fraternal twins. Both went to the same university, have similar educational levels, and received $50,000 inheritances from their grandparents ten years ago. But that’s where the similarity ends.

Jessica is electrified by risk: She owns individual tech stocks, dabbles in options trading, and once bought a cannabis penny stock based on a Reddit thread.

Michael, on the other hand, is anchored in caution: he holds 5-year GIC ladders, keeps a large cash cushion, and hasn’t invested in equities since he panicked and sold his few stock positions during the 2008 downturn.

They’re both smart, caring people with nearly identical backgrounds. So why are their financial behaviours so different, and where might that lead?

The Emerging Cracks in Their Financial Paths

Jessica’s Story

After a few strong years, a few catastrophic trades—including a naked call on a meme stock—set her back $20,000 in one year. Jessica’s reluctant to admit it to her friends and rationalizes it as “part of the game.” Yet her assets set aside for retirement are underfunded and volatile.

Michael’s Story

Inflation is eroding the real value of his savings. Michael has no equities, only modest TFSA growth, and is worried about outliving his money, but can’t bring himself to take any financial “risks.” He feels stuck.

The problem isn’t intelligence; it’s emotional framing. Jessica frames the investment world through the lens of opportunity and excitement. Her emotional framing emphasizes the upside—how much she could gain—not the probability or consequences of loss. This framing pushes her to pursue speculative strategies and ignore warning signs because she interprets volatility as “potential.” Emotionally, Jessica sees every market dip as a thrilling discount or a missed win, not as a signal to be cautious.

As for Michael, he frames investing through the lens of safety and regret avoidance. He dwells on past losses or scary market stories, so new information about investments is filtered through fear. This leads him to see even modest risk as dangerous, reinforcing his preference for guaranteed returns like GICs—even at the cost of long-term growth. Emotionally, Michael sees uncertainty not as possibility, but as peril, something to be sidestepped rather than managed.

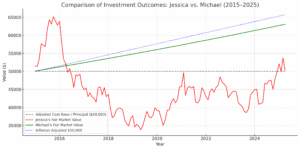

The chart below is a hypothetical comparison of how Jessica and Michael’s respective approaches to investing might work out, each starting with their respective $50,000 in inheritance money. Jessica’s red line reflects her volatile investment style, while Michael’s green line represents a pure GIC investment strategy, returning on average, 2.25% per year. The dotted blue line shows the inflation-adjusted value of $50,000 in 2015. Average inflation over this period was approximately 2.68%. In other words, unless your investment return has exceeded the blue dotted line, you have not kept up with inflation, let alone increased your “real” value.

Chart: ChatGPT Jun 16, 2025

This is where many Canadian investors may find themselves: caught at one end of the risk spectrum, making decisions out of fear or thrill, but not achieving any success.

Healthy investing isn’t about avoiding or embracing risk

Investment risk is all about managing it intentionally. Behavioural finance studies show that both overconfidence and loss aversion are common traps.

Risk-seeking Jessica is influenced by:

-

- Overconfidence bias

- Recency effect (recent wins)

- Optimism bias

- FOMO and social media

Risk-averse Michael is influenced by:

-

- Loss aversion

- Availability bias (anchored in past losses)

- Status quo bias

- Catastrophizing

Both approaches ignore the real purpose of investing: to serve your goals over time with a reasonable likelihood of success. A financial plan that is based on values and goals serves as a compass for decision-making by helping investors connect their day-to-day financial choices to what truly matters to them over the long term. Rather than chasing returns or avoiding risk in the abstract, a disciplined plan focuses attention on clearly defined life goals, such as retiring comfortably, supporting aging parents, or helping children through post-secondary education. Grounded in personal values, this approach encourages intentional investing: for the risk-seeking Jessicas of the world, it offers guardrails to avoid impulsive decisions that can derail long-term progress; for the risk-averse Michaels, it provides reassurance that taking some calculated risk is not gambling, but a necessary part of reaching important life outcomes. By keeping the focus on purpose rather than short-term performance or fear of loss, a well-constructed financial plan introduces both discipline, the ability to stay the course, and direction, a meaningful destination to move toward.

Imagine Jessica and Michael with a Financial Plan

Jessica builds a diversified portfolio with a small portion for high-risk ideas (capped at 5% of her portfolio’s value). Her retirement contributions are automated, and she stops checking her accounts daily. She still gets to feel a thrill, but now it’s from watching her net worth grow steadily as new milestones are achieved.

Michael starts with a balanced fund in his TFSA, supplementing his laddered GIC structure. He begins to understand that risk is less about short-term volatility and more about failing to meet long-term needs. He sets a modest equity target of 30% to begin with and gradually increases it with confidence.

Both feel more in control, not because their personalities have changed, but because their strategies now reflect who they are and what they need.

Takeaways

- Risk is not the enemy; unmanaged risk is

- Ask yourself:

- Am I avoiding growth because of fear?

- Am I chasing returns without a plan?

- Consider working with a financial planner to:

-

- Define your goals

- Understand your natural risk tendencies

- Build in structures and commitments that reflect who you are, without letting emotion drive your decision-making

-

Supplementary Information

Investor Personality

“What’s Your Risk Personality?” Most of us probably fall somewhere between the extremes of twins Jessica and Michael. If you would like to investigate your own investment risk personality, check out this quiz available through the Ontario Securities Commission’s financial education website, Get Smarter About Money.ca: Investor Personality Quiz.

Wealth Personality

TD Wealth provides a few short questions to create a TD Wealth Personality™ profile. You can receive some basic information by going through this quiz. https://www.td.com/ca/en/investing/wealth/behavioural-finance/wealth-personality. Full details are not available unless you contact an investment advisor with TD Wealth.

Risk Attitudes Profiler

The Risk Attitudes Profiler measures the strength of two opposing psychological traits: the desire for security, emotional stability, and peace on one hand, and the need for a dynamic life filled with risk-taking and excitement on the other: https://www.humanmetrics.com/risk-taking. The free version gives you limited information, but it will place your responses on a risk-attitude continuum.

Classic Behavioural Biases

Both Jessica and Michael live with some of the classic behavioural biases that tend to trip up investors. Do you see yourself in any of these behavioural tendencies?

- Overconfidence Bias: People tend to overestimate their knowledge, skill, or ability to predict outcomes, leading to excessive trading or risky bets.

- Recency Effect: Recent events are given too much weight in decision-making, causing investors to chase trends or assume recent performance will continue.

- Optimism Bias: There is a natural tendency to believe that positive outcomes are more likely than they really are, and that negative events “won’t happen to me.”

- FOMO (Fear Of Missing Out): Seeing others profit can trigger emotional decisions, leading to impulsive investing in popular or speculative assets.

- Loss Aversion: Losses are felt more intensely than gains of the same size, which can result in avoiding appropriate levels of investment risk.

- Availability bias (anchored in past losses): People judge risks based on how easily they can recall vivid or painful past events, such as market crashes, leading to undue caution.

- Status Quo bias: Many people prefer familiar options and resist change, even when doing so means missing better opportunities.

- Catastrophizing: Faced with uncertainty, the mind often fixates on worst-case scenarios, which can lead to paralysis or overly conservative strategies.

A quotation from Jason Zweig in Your Money & Your Brain (2007)

“When possibility is in the room, probability goes out the window” (p. 46). This summarizes the attractiveness of high-risk bets, where our emotions register potential gains over realistic odds, often overriding rational judgement.

This is the 292nd blog post for Russ Writes, first published on 2025-06-16.

If you would like to discuss this or other posts, connect on Facebook, Twitter aka X, LinkedIn, Instagram, Mastodon, or Bluesky.

Click here to contact me for an appointment.

Click here and select FinPlan30: Financial Planning in 30 min under Specific Questions for a 30-minute free no-obligation financial planning conversation.

Click here for a 2-week free trial of the Money Architect Financial Planning platform.

Disclaimer: This blog post is intended for general information and discussion purposes only. It should not be relied upon for investment, insurance, tax, or legal decisions.